Vantage Point Trading

Vantage Point Trading

Born in 1954, Jones earned a degree in Economics from the University of Virginia, in 1976. He actually started his career as a clerk on the trading floor. Overnight positions refer to open trades that have not been liquidated by the end of the normal trading day and are quite common in currency markets. Factors like emotions and slippage(the difference between the expected price of a trade and the price at which the trade is actually executed) cannot be fully understood and accounted for until trading live. Additionally, a trading plan that performed like a champ in backtesting results or practice trading could, in reality, fail miserably when applied to a live market.

Many people like trading foreign currencies on the foreign exchange (forex) market because it requires the least amount of capital to start day trading. Forex trades 24 hours a day during the week and offers a lot of profit potential due to the leverage provided by forex brokers. Forex trading can be extremely volatile and an inexperienced trader can lose substantial sums. The forex market is the largest and most accessible financial market in the world, but although there are many forex investors, few are truly successful ones. Many traders fail for the same reasons that investors fail in other asset classes.

From Amsterdam, Forex trades throughout the whole world were initiated. The greatest volume of currency is traded in the interbank market. This is where banks of all sizes trade currency with each other and through electronic networks. Big banks account for a large percentage of total currency volume trades. Banks facilitate forex transactions for clients and conduct speculative trades from their own trading desks.

Therefore, according to these beliefs, not the Forex trading itself is prohibited, but a swap. I did not gamble when I set up a successful business as I followed all the steps such as research, business plan, strategies, educations and even the finances etc. Exactly the same steps I followed when I started a successful Forex trading career.

If a trader loses 10 pips on losing trades but makes 15 on winning trades, she is making more on the winners than she's losing on losers. This means that even if the trader only wins 50% of her trades, she will be profitable. Therefore, making more on winning trades is also a strategic component for which many forex day traders strive. Not all brokerage firms offer forex trading, so make sure it’s available before you open an account. Working with a broker that offers multiple outlets for customer service is highly recommended for beginning traders.

Your personal trading style will largely determine your profitability or lack of it. Though, how much money you trade forex with will play a significant role in your ability to meet your trading goals.

This isn’t just an eBook, it’s a course to build your skill step by step. If want to take a trade that has 50 pips of risk, the absolute minimum you can open an account with is $500. This is because you can risk $5 per trade, which is 1% of $500. If you take a one micro lot position ($0.10 per pip movement, and the smallest position size possible) and lose 50 pips you’ll be down $5.

Essentially, you watch the prices of currency move up and down, and speculate on whether you think they will increase or decrease. You can then buy or sell the currency in an attempt to earn a profit. If you buy a currency that then goes up in value, it’s worth more than when you bought it, so you’ve made a profit. It’s a relatively simple concept, but it’s extremely important to learn as much as you can before you try it out. free beginners forex trading guide which provides expert tips and insights on the market and ways to trade.

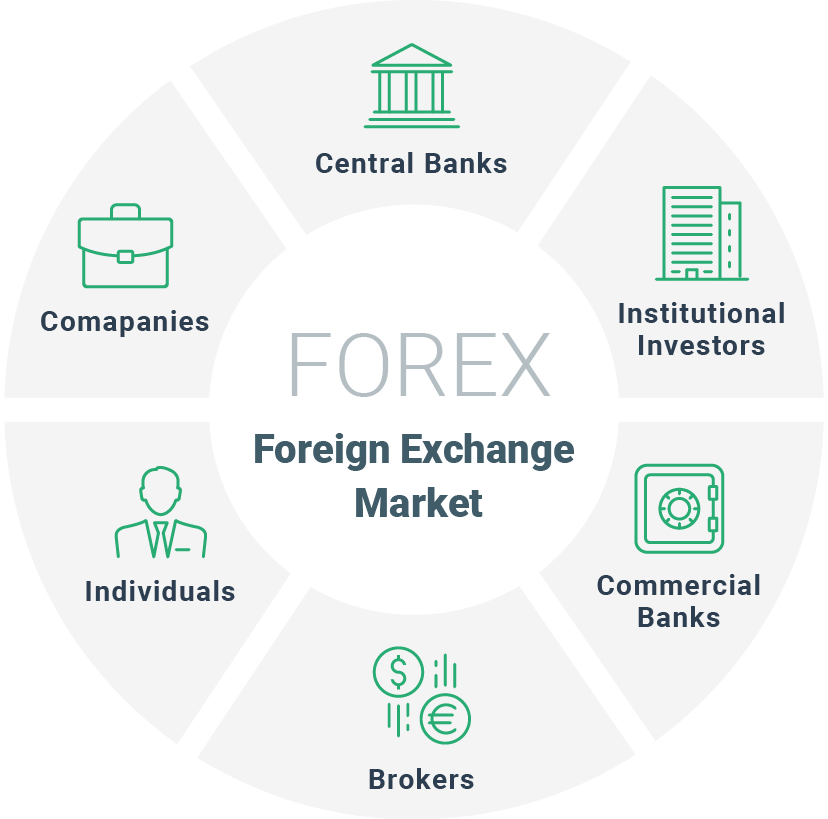

Central banks move forex markets dramatically through monetary policy, exchange regime setting, and, in rare cases, currency intervention. Corporations trade currency for global business operations and to hedge risk.

Though forex trading (the exchange of foreign currencies) may seem complicated, the truth is that most people can get started with a new account in as little as a single afternoon. ActionForex.com was set up back in 2004 with the aim to provide insight analysis to forex traders, serving the trading community over a decade. Empowering the individual traders was, is, and will always be our motto going forward. Moreover, self-respecting Forex brokers, through which people trade on the market, should receive a special license confirming that they are regulated by higher authorities.

- This will help a trader take full advantage of trading losses in order to decrease taxable income.

- he mastered and know the trend direction so well because he had dedicated so much time to trading, but he always believe hes right and expect the profit to continue.

- I have been very confused by the topic of reading many websites about trading, and I need your opinion or advice that can guide me.

- Those that offer the services usually do not charge any transfer fees.

- This was due to the flood of selling in the market from other speculators following Soros' lead.

Also, there is very little volume in the e-mini and e-micro Euro FX futures contracts (and even less many other currency futures contracts), so it is not an ideal way to trade currencies with a small account. When you sell a peso future, you selling pesos (MXN) and buying the USD. You could do the same in the forex market, by selling MXN/USD. For any currency transaction, whether dealing with physical currency when at a bank, trading a futures contract or trading a forex pair, you are always dealing with 2 currencies.

Can Forex Trading Make You Rich?

It is of 14 if you deposit between $5,000 and $10,000. Unfortunately, a mobile app for EuropeFX is not on offer.

You don’t need leverage, nor am I saying you should get it. For many new traders leverage will result in a rapid depletion of their capital, and not big gains. If you have a solid method though, leverage can be beneficial. You can only trade the capital you have, and when you trade it, I don’t recommend losing more than 1% of it on a trade.

When you are just learning forex trading, this isn’t likely to be the case, but as you start to work the system and figure out when to buy and when to sell, you can make huge amounts of money. There have been many success stories involving people, with very little money to start off with, working and trading their way up to the big cash. Michael Marcus is amongst the best professional FX traders in the world. He is the founding member of the Commodities Corporation Company.

Once open, your trade’s profit and loss will now fluctuate with each move in the market price. A standard stop loss order, once triggered, closes the trade at the best available price. There is a risk therefore that the closing price could be different from the order level if market prices gap. An order is an instruction to automatically trade at a point in the future when prices reach a specific level predetermined by you. You can utilise stop and limit orders to help ensure that you lock in any profits and minimise your risk when your respective profit or loss risk targets are reached.

With the MetaTrader 4 platform, you’ll enjoy easy-to-read, interactive charts that allow you to monitor and analyse the markets in real-time. You’ll also have access to more than 30 technical indicators which can help you to identify market trends and signals for entry and exit points. MetaTrader 4, also known as MT4, provides access to a range of markets and hundreds of different financial instruments, including foreign exchange, commodities, CFDs and indices. There are seven Major currency pairs on the forex market.

In other words, the futures contract moves based on the underlying forex pair. When you trade EUR futures, you are trading the EURUSD. Futures contracts just force you trade in 125,000 blocks of currency (or 62,500 for the mini contract), where in the actual forex market you can trade in blocks of 1000, 10,0000 or 100,000.

The broker is extremely transparent about the risks of crypto trading. It is one of the very few platforms that in the risk disclaimers also include a percentage of the total accounts that lose money when trading CFDs.

Комментарии

Отправить комментарий