Swing Trading 11 Commandments: Strategies for Technical Analysis

Swing Trading 11 Commandments: Strategies for Technical Analysis

Next, traders check to see whether any filings have been made by searching the SEC's EDGAR database. If there is material information, it should be analyzed in order to determine whether it affects the current trading plan. A trader may also have to adjust their stop-loss and take-profit points as a result. The retail swing trader will often begin his day at 6 am EST, well before the opening bell.

If you keep trading with a balance below $10,000 you will be risking more than 1% (risking at least $100 per trade). If you expect to make 5% per month (how much you make will vary by strategy) on a $30,000 account, that’s a $1500 per month income, less commissions. If you try to swing trade with $1000 or $2500 (and make 5% per month), most of the $50 to $125 profit will be eaten up by commissions and fees, leaving you with very little, if any, profit.

Swing trading involves holding a position either long or short for more than one trading session, but usually not longer than several weeks or a couple months. This is a general time frame, as some trades may last longer than a couple of months, yet the trader may still consider them swing trades. If going long in an uptrend, some traders utilize new highs to exit positions once the price starts to fall from the swing high. The speed, fluctuations, adrenaline, and comparatively high loss ratio relative to wins can make investing a jarring experience for new day traders. This runs against the basic human impulse to “win” as much as possible.

I Took A Couple Years Off Of Work To Swing Trade. Here’s What Happened.

The EMA crossover can be used in swing trading to time entry and exit points. Most investors will choose to buy their positions and then hold on to them, waiting for market conditions to improve before they make a trade. There are those investors who are incredibly patient, waiting for years and collecting small dividends over time as their returns. Then there are those that are in a hurry to get their returns, especially if there is a small appreciation in the pair they are trading.

Account for that when determining how much you will deposit. Study the stock charts, decide how and where you will enter and where you will place a stop loss.

Without a doubt when you are day trading you should not be multitasking with the television or talking on the phone. You will likely trade during specific time frames (e.g. morning or afternoon).

Do not let bad trades affect you longer than necessary. Learn from your mistakes; poise yourself to make your next trade. I always strive to select trades whose target allows me strong profits if I'm correct, but where my potential losses are fairly limited.

The best candidates are large-cap stocks, which are among the most actively traded stocks on the major exchanges. He has over 18 years of day trading experience in both the U.S. and Nikkei markets.

The information contained on this video is for informational and educational purposes only. We are not registered as a securities broker-dealer or as investment advisers, either with the U.S. Securities and Exchange Commission or with any state securities regulatory authority. We are neither licensed nor qualified to provide investment advice.

- Alternatively, the trader may opt to exit before the price reaches resistance and the prior swing highs.

- Assume you use a strategy that places a 50 pip stop loss and 150 pip target.

- If you can't day trade during those hours, then choose swing trading as a better option.

- For example, you can speculate on the latest altcoins, such as a bitcoin (BTC), ethereum (ETH) and litecoin (LTC).

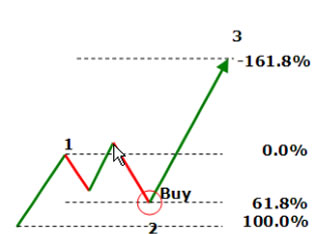

- For example, if a trader went long near the swing low, they could set a profit target at the 61.8% 100%, or 161.8% Fibonacci levels.

Options are a “derivative” in that their value is derived from an underlying market, such as a stock or futures contract. For a strategy on trading options, and a basic rundown of what they are, see Debit Spread Options Trading Strategy. If you risk 1% of $20,000, you can risk up to $200 per trade.

Of course more capital can be utilized in the same way. Understanding how position sizing works is a key in determining how much capital you’ll need to swing trade stocks. Now that you know about that, we can use it to see how much your balance/deposit should be if you want to swing trade.

Market risk – Rule 101 – you can definitely lose money. Although some have made it look easy, any mistakes will be felt where it hurts the most, your income. And unfortunately, as is the nature of market speculation, lessons are often only learnt the hard way. In addition, trading on margin and using leverage could see you lose more than your initial investment. Tools – You can swing trade using candlesticks and other techniques on any number of platforms, from Robinhood to MetaTrader.

On the other side of the spectrum, some traders look for stock prices that are going up strongly. The main idea is that winning stocks tend to keep on winning, so they intend to buy at high prices and sell at even higher levels.

One of the sports statistics I find most relevant to swing trading is baseball legend Ted Williams' record-setting batting average. While Ruth's home run record has been bettered several times, Williams' record has not yet been beat. Not only does it often result in a loss of trading capital, but it also hurts one's self-esteem.

You are trying to make a living instead of making a killing. Note they are also more than a place to consider quotes and exchange securities. They can help you build a diverse watchlist, portfolio, and so much more. Utilise the news –Markets are constantly moving in reaction to news events. Many resources, such as Yahoo Finance and CNBC will provide market analysis and commentary, using volume, price action and weekly charts.

I suggest you print this and put it somewhere near your trading area. Every once in a while you might want to check this information to evaluate whether you are violating any of these principles. Violate the principles of effective swing trading and you will have your knuckles rapped with the painful loss of trading capital.

Support and resistance levels can signal whether to buy a stock. Bullish and bearish crossover patterns signal price points where you should enter and exit stocks. Learn how to identify wide range candles as these make it easier to reveal turning points within the swing trade. With this, you will be able to find out when a stock may reverse.

Комментарии

Отправить комментарий