How Much Money Can I Make Forex Day Trading?

How Much Money Can I Make Forex Day Trading?

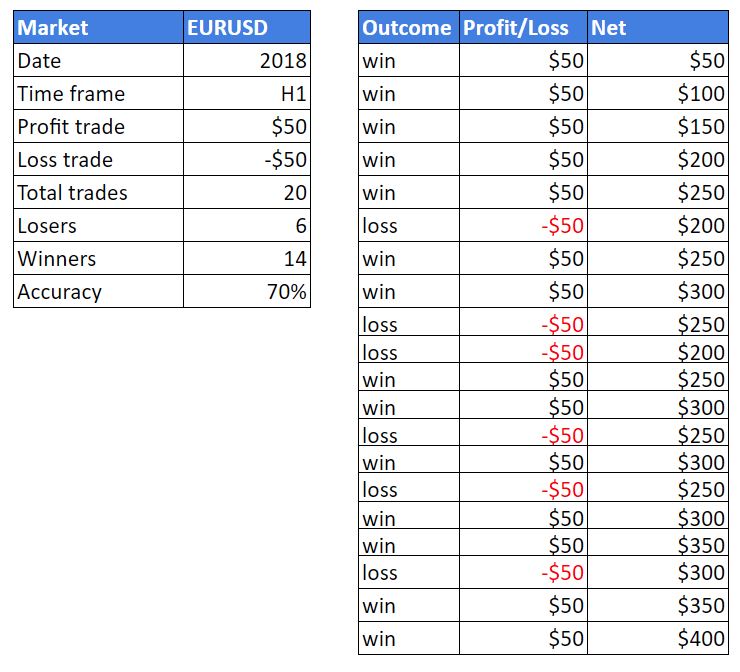

You have a forex trading strategy that wins 70% of the time, with an average of 1 to 3 risk to reward. Many times this question comes from retail traders that are not finding any success with their trading approach.

But what you don’t hear is that for every trader that attempts it, thousands of other traders blow up their account. A trading community dedicated to helping traders succeed. The job you have trading currencies is to implement that trading plan. Traders that do everything in a consistent manner are sticking to a proven edge.

However well designed a system is, losses are inevitable in this market. The company holds some money in reserve for exactly this purpose. Rofx has a compensation fund from which funds can flow to offset losses on the unprofitable trading days. If you invest $10,000 in a successful strategy today you will receive a net profit of more than $500 per month.

I’m going to pull the trigger on a live account in a few months and I wanted to know your opinion of brokers available to US customers. I’ve been trading on the FXCM tradestation platform and I feel really comfortable with my set up.

We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading. Unfortunately, there is no universal best strategy for trading forex. However, trade at the right time and keep volatility and liquidity at the forefront of your decision-making process.

So, the exchange rate pricing you see from your forex trading account represents the purchase price between the two currencies. Profitable forex trading and your success as a trader greatly depends on a high level of discipline. A well-thought-out strategy will always help you to avoid emotional trading and behavioral biases, and enable you to stay focused. In short, if you take big risks, you can make a lot of money in short period of time but the bad side of that is that a few bad high risk trades and you lose a lot. Instruments trade differently depending on the major players and their intent.

Such a dynamic shows that the trader cuts losers quickly and let winners run. Once you recognise a trend – get in, sit back and ride it.

Trade forex with stops and limits set to a risk/reward ratio of 1:1 or higher

It instructs the broker to close the trade at that level. A guaranteed stop means the firm guarantee to close the trade at the requested price. From cashback, to a no deposit bonus, free trades or deposit matches, brokers used to offer loads of promotions. Our directory will list them where offered, but they should rarely be a deciding factor in your forex trading choice.

This is one of the best things about the Forex market, as you can easily not only purchase the assets, but sell them without owning them. Even so, with a decent win rate and risk/reward ratio, a dedicated forex day trader with a decent strategy can make between 5% and 15% a month thanks to leverage. Also remember, you don't need much capital to get started; $500 to $1,000 is usually enough. If you're day trading a currency pair like the GBP/USD, you can risk $50 on each trade, and each pip of movement is worth $10 with a standard lot (100,000 units worth of currency). Therefore you can take a position of one standard lot with a 5-pip stop-loss order, which will keep the risk of loss to $50 on the trade.

- It went up over Christmas and then I went into us oil and then that went up but I did forex and lost it all.

- It won't always be possible to find five good day trades each day, especially when the market is moving very slowly for extended periods.

- When take a lot of risk in a trade, that’s bad forex money management.

- In fact, a surplus of opportunities and financial leverage make it attractive for anyone looking to make a living day trading forex.

- Good, sustainable strategy is less than 50% accurate.

In this example, the expectancy of your trading strategy is 35% (a positive expectancy). This means your trading strategy will return 35 cents for every dollar traded over the long term. You can have a 1 to 2 risk to reward on your trades.

Going through the types of trading, many beginners select scalping. They are attracted by the simplicity of this approach and the rapid completion of transactions. In fact, scalping requires a lot of effort and attention.

Trading forex is full of misconceptions indeed.

The Rofx.net robot can read charts, make calculations and send trading signals much faster. This is a task that can be overwhelming for humans. It can detect the small stuff that a human can easily miss and make all the difference. You can easily how its potential to make money is several times greater. That is human nature to feel superior when gaining profit and to feel defeated when experiencing loss.

You might end up worse off in terms of a total profit. What would you consider to be an average Risk/Reward ratio? Traders are expecting to make 100%, 200%, 500% in few weeks. They are designed to make trading Forex very attractive by promising the impossible.

The trading shall also not exceed 20% of the total capital of the trader. Jonathan shall not expect the Forex trading to become its main source of the profit gaining in the nearest couple of years. The wise thing for Jonathan to do in order to start trading profitably is to create a demo account first and to try trade without spending actual money. That is always better to start small, that will allow you to go far over time. A good trading strategy will produce most profits out of the least winning positions.

I finished with £172.89, 8.5 per cent down on my initial investment. I made 35 trades in total – 15 were profitable and the rest lost money. Like three-quarters of retail forex traders, I proved to be a flop. Subscribe to a Forex newsletter that offers expert insight and commentary into the Forex markets on a daily basis. The Action Forex newsletter is a free service that you might investigate.

Depending on the direction of a bet, traders then decide to buy or sell. The price interest point, or PIP, is a term used to refer to gains or losses in trading, and is the smallest price move in an exchange rate. For currency pairs priced to four decimal places, one pip is equal to 0.0001 — or 1 basis point. The high liquidity of the forex market vests gives it dynamic and rapid price movement, which creates multiple opportunities for retail traders.

There are regulators in it, there is a participation of state financial institutions. But the market is international, due to which everyone has access to it and no one can close it, influence its development, change the conjuncture. Registration of broker and investment companies to provide access to international trading is carried out through regulators, through obtaining licenses.

Комментарии

Отправить комментарий